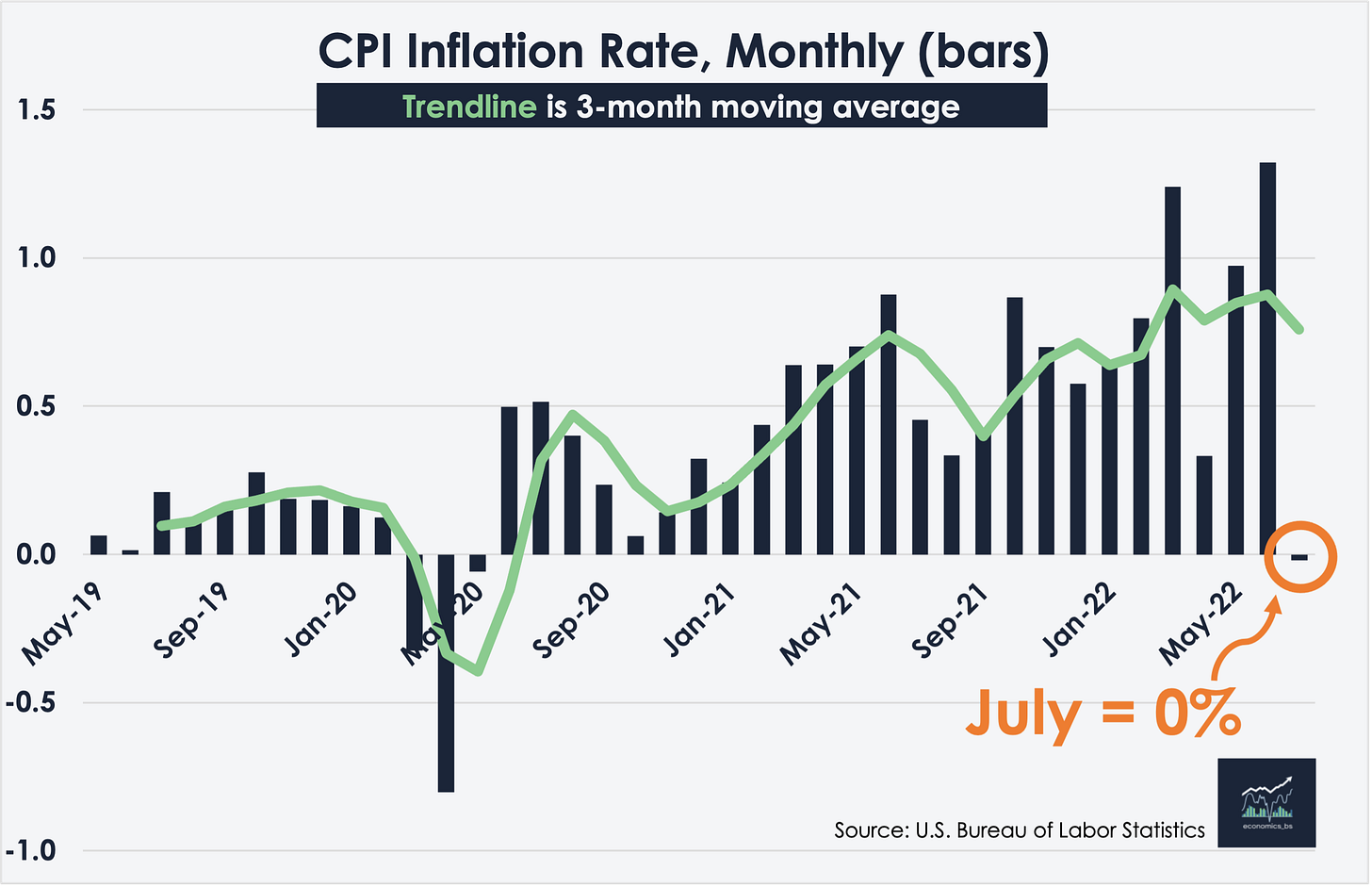

Inflation was 0% in July. Why does that matter?

We are seeing the first signs that inflation is slowing down, which is welcome news for the economy as a whole.

The month-over-month inflation rate was 0% — does that mean we solved inflation? We won? No, that’s BS.

However, it’s a welcome relief for an economy that saw monthly increases of at least 1% in 3 of the past 4 months (keep up that pace and you are at more than 12.5% inflation over a full year). July’s reading was the lowest we’ve seen since the beginning of the pandemic and you have to go back to mid-2019 to find another such reading.

How did we get here?

The biggest driver in July was the fall in energy prices, especially gasoline. Energy prices, as an aggregate category, were down more than 4.5% and gasoline prices decreased more than 7.5%. Used car and truck prices also decreased (0.4%) in what has been an unusually strong year for that market. This is welcome news to… well, anyone who drives a car or buys anything that uses fuel in the delivery process. So everyone. Remember, fuel does not only go in your gas tank. Companies also need fuel to move goods from one place to another. As these costs come down that should allow companies to stop increasing prices as fast (and hopefully even decrease a few). We already see some evidence of this in the Producer Price Index, as it decreased for the first time in nearly two years after not dipping below 0.5% monthly increases during the past year:

However, there were some categories in the CPI that continued their rapid increase; notably, food and housing. Food (prepared at home — groceries) increased 1.3% in July and is up 13.1% year-over-year with no signs yet of slowing down. Similar story for housing, which was up 0.5% for July (steady relative to past few months) and 5.7% year-over-year. The decline in gas prices might provide some psychological relief to people, but paying rent and trips to the grocery store still hurt.

What does this mean going forward?

Well, first, let’s confront what it doesn’t mean. When the inflation rate decreases, that does not mean prices are falling. It simply means prices are rising more slowly.1 So, when you think about “getting inflation under control” you can forget about going back to pre-pandemic prices. That world is gone. At least for most items. Food and gas prices may actually decrease, but those tend to be more volatile (which is why many people, policymakers included, prefer “core” price index measures that strip away these elements). I suspect prices for things like rent/housing will not decrease, at least not quickly.

Why can prices not just return to what they were before the pandemic?

Do you want to take a pay cut? No? That’s a major reason why. Businesses don’t often lower their employees’ wages (at least in normal, non-pandemic times). When the inflation rate started to increase last year, some Federal Reserve officials (the people in charge of monitoring prices in the economy) argued that inflation was transitory, which is basically a fancy word for temporary. They believed the inflation rate would briefly spike, the world would get its supply chain issues figured out, and the inflation rate would return to its normal level.

Unfortunately, the Fed was wrong. In their defense, the supply-chain issues were unlike anything we’ve ever seen. The pandemic also caused severe interruptions. People can’t work if they are sick or caring for loved ones, which led to worker shortages and higher labor costs. Then Russia invaded Ukraine, which led to more instability and volatility in energy markets. Once these (and other) issues persisted long enough, we started to see so-called pass-through to other prices. For example, high gas prices led grocery stores to raise prices, as their suppliers started charging them more. Used and new cars increased in price due to a shortage of semi-conductor chips. New homes and rent started increasing rapidly because building materials were harder to find and took longer to arrive.

Workers also started negotiating higher wages. And, rightfully so.

The pandemic started to spiral again in early 2021, except this time things were more “open” in more places, so demand for goods and services was rising, people had cash from stimulus payments, and there was a shortage of workers. All these add up to higher prices. That brings us to today, where wages are increasing at an annual rate of 5.1% which is still not enough to keep up with the annual inflation rate of 8.5% (on a year-over-year basis).2 Wages tend to be "sticky" in the sense that they don't change as much or as often as something like airline or gas prices. Wages also tend to be one of the largest expenses for a company, so as wages rise we should expect the overall inflation rate in the economy to remain elevated. Is this a bad thing? No.

We want wages to rise faster than inflation. That allows us to expand our standard of living. It might just take us a while to get there and the road could be bumpy.

Takeaways (without the BS)

Inflation was 0% in July, which brought the annual inflation rate down to 8.5% (from 9.1%). Gas prices are falling but food prices are still rising too fast. Wages are increasing, but not as fast as prices. We are generally moving slowly in the right direction, but we should always use caution when discussing a single data point.

Quick technical note: Economists use the term disinflation to refer to an inflation rate that is positive (greater than 0%), but slowing down. The year-over-year inflation rate in July was 8.5% compared to 9.1% for June. This is disinflation. We use deflation to refer to a decrease in the aggregate price level (when the rate is less than 0%).

If something is measured on a year-over-year basis, this just means we use the current month and year as the ending point and the same month last year as the starting point.