Weird, right? In case you missed it, the context for my current rage is this:

So, Biden says there was no inflation in July – how is that possible?! Didn’t we just have 9% inflation? Yes, and we still have 8.5% inflation…on a year-over-year basis. It is also correct that there was 0% inflation in July.

It might help to start with a basic definition, so we are all speaking the same language. In Economics, inflation refers to the rate at which prices are increasing over some period of time (deflation would be analogous but for decreasing prices). When prices rise, we have inflation – simple as that.

Or is it?

You might ask: “Yeah, but there are literally millions of prices; how do we put that into one number?”

The answer to that question seems to be partly why there is so much confusion. While the prices of some of the things you buy likely went up in July, there are simultaneously prices of other things that went down (shoutout to gas prices). The Bureau of Labor Statistics (yes, they do labor and prices) uses what they call the Consumer Price Index (CPI) to track inflation.

To create this index, they survey thousands of people over time to see what they buy. They ask you what is in your typical shopping cart (maybe you call it a basket or, if you’re from the American south, then you probably call it a buggy). For example, housing is by far the largest expense for most people, so it gets the largest weight in the CPI basket. This means a 1% increase in housing prices will have a larger effect on overall inflation than a 10% increase in the price of your daily coffee. According to the BLS:

The CPI represents all goods and services purchased for consumption by the reference population. BLS has classified all expenditure items into more than 200 categories, arranged into eight major groups (food and beverages, housing, apparel, transportation, medical care, recreation, education and communication, and other goods and services). [their emphasis, not mine; see their FAQ]

This is important because we often want to know if the inflation rate is caused by a big change in one category or if it is a broad increase in all categories. As you can see below, food and energy prices (especially energy!) have risen much faster than the overall index (far left bar) during the past year. This is because there are lots of other items in the CPI basket that have not increased as fast. Policymakers tend to closely follow so-called core measures that remove the impact of volatile food and energy prices (far right bar).

Ok, hopefully we are all on the same page now. Inflation refers to the rate of change in prices over some time period. To have a single measure of the inflation rate, we need one measure of all prices. Therefore, we use a price index. Let’s revisit our angry, hyperbolic person from earlier:

Specifically, the person says,

“pro tip: inflation is NOT the same as the rate of change of cpi”

Joe Weisenthal justifiably responds in confusion because that is exactly what inflation is. At least, that is how we define it in common usage in the field of economics. I went down the rabbit hole to see if I could understand why Nick Boyer was confused. Nick seems to be hung up on the second part of the “Oxford Languages” definition which says inflation is:

“a general increase in prices and fall in the purchasing value of money”

But these are two sides of the same coin! This only happens when…prices rise. And we measure prices using a price index like CPI. If Nick wants to propose a new measure of prices, then that is fine. There are already several that are in usage, including the price index for personal consumption expenditures (PCE) favored by monetary policymakers.

Perhaps you want to scream something about inflation being growth in the money supply, but that is only correct if/when money supply growth leads to a change in prices. If I make $100 at my job, and my shopping cart cost increases from $85 to $95, then the purchasing value of my money has fallen …because prices increased.

A look at how changes in the money supply leads to increases in prices is beyond the scope of this rant, so we’ll leave that for another day.

Joe (Weisenthal and Biden) made a simple statement of fact: the CPI basket did not increase in price in July. By definition, this means inflation was 0% for that month.

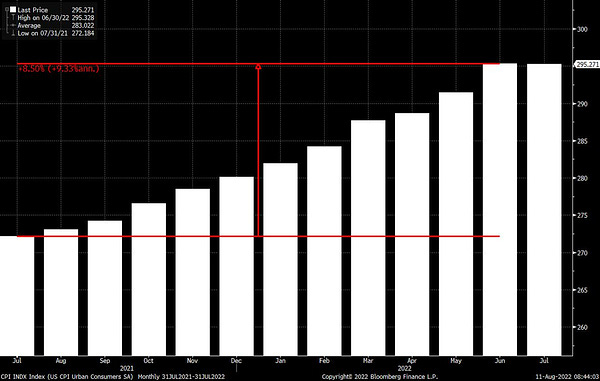

Part of the broader confusion about the inflation report seems to stem from the fact that we typically report and think about numbers in an annual (yearly, sometimes referred to year-over-year) format. If you look at inflation over the past 12 months, then July 2021 to July 2022 saw an inflation rate of 8.5%. This is a decrease from the June 2021 to June 2022 inflation rate of 9.1%. These are welcome developments. The July reading is interesting and important because it shows that prices (broadly measured by the CPI) stopped increasing. If this trend continues, then the annual inflation rate we generally focus on will keep decreasing. Even if the CPI keeps increasing, the year-over-year rate can keep declining.

I might do a separate post at some point in the future about why politicians would be wise to stop dunking on each other over monthly inflation readings. Not touching that hornet’s nest right now, though.

TAKEAWAYS (TL;DR)

The CPI was unchanged in July, which means prices did not increase. The 12-month inflation rate (July 2021-July 2022) decreased from 9.1% to 8.5%. This does not mean prices are currently rising 8.5% and it does not mean prices will rise 8.5% over the next year. It means prices have risen 8.5% since July 2021. The welcome news is that inflation seems to be finally cooling off.